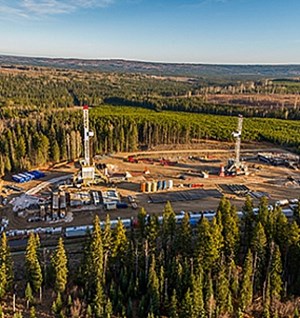

(Bloomberg) – Chevron Corp. has begun marketing its Duvernay shale holdings in Alberta as the oil giant divests assets following its agreement to buy Hess Corp.

Chevron plans to shed all of its 70% stake in the Western Alberta oil and natural gas play, spokesman Braden Reddall said in an email. Other assets in Canada won’t be affected. The company inked a $53 billion deal to acquire Hess in October.

“Chevron will be soliciting and reviewing expressions of interest, but there are no assurances of any sale,” Reddall said.

Chevron has been one of the largest drillers in the Duvernay, a rich producer of condensate, light oil and gas. The company is looking to sell as much as $15 billion of assets by the end of 2028 in an effort to “high-grade” its portfolio and focus capital spending on the most productive areas, such as the Permian basin and Guyana.

The California-based company is looking to step up performance this year after its stock tumbled 17% in 2023, worse than its supermajor peers. It faced a multitude of operational difficulties, ranging from refinery disruptions to lower-than-expected Permian production to cost increases at its $45 billion Tengiz project in Kazakhstan.